If you’re searching for repossession help, you’re not alone.

If you’re searching for repossession help, you’re not alone.

Across the UK, repossessions are rising again after years of unusually low activity. Mortgage repossessions jumped sharply in 2025, with lenders taking possession of 5,160 homeowner properties — up 39% in a year.

Other figures show a similar trend, including a 51% annual increase in homeowner repossessions and a significant rise in buy-to-let repossessions too.

While levels remain below the peaks seen after the 2008 financial crisis, the direction of travel is clear: more people are falling behind on payments, and more homes are being taken back by lenders.

For both owner-occupiers and landlords, the message is simple — repossession is rising, and prevention is always better than recovery.

Why repossession is the worst possible outcome for property owners

Many people assume repossession is simply another way of selling a property when finances become unmanageable. It isn’t.

Repossession is typically the most financially damaging way to lose a property — and the most stressful.

When a lender repossesses a home, they take full control of the sale process. That usually means:

You lose control over price and timing

Lenders sell to recover their debt, not to maximise your profit. Speed and certainty matter more than achieving the best market value.

Extra costs are added to your debt

Legal fees, repossession costs, arrears interest and selling expenses are usually charged to the borrower — increasing the amount owed.

You may still owe money after the sale

If the property sells for less than the mortgage balance and fees, you remain liable for the shortfall.

Your credit record is severely damaged

Repossession can affect borrowing ability for years — including mortgages, loans and even rental applications.

Stress and disruption are extreme

Court action, eviction and sudden relocation create significant emotional and practical pressure.

In short: repossession removes choice, reduces value, increases debt and limits your future options. That’s why most advisers view it as the outcome to avoid at almost any cost.

The human impact: what happens if you lose your home

For owner-occupiers, repossession doesn’t just mean losing an asset — it can mean homelessness.

Local councils have legal duties to help some people who become homeless, but support is not guaranteed and housing shortages are severe across much of the UK. Many households spend long periods in temporary accommodation, and some may wait months or even years for permanent social housing — if they qualify at all.

Temporary housing can include:

-

Hostels

-

Bed and breakfast accommodation

-

Short-term private rentals

-

Accommodation outside your local area

Families are sometimes relocated far from work, schools or support networks.

This is why preventing repossession — or taking control by selling early — is almost always the safer route.

Repossession help: what to do if you’re struggling with mortgage payments

If you’re worried about repossession, there are many steps you can take before deciding to sell — especially if your financial difficulty is temporary.

Speak to your lender immediately

Lenders are usually required to treat borrowers fairly and may offer:

-

Payment holidays

-

Temporary reduced payments

-

Mortgage term extensions

-

Switching to interest-only

-

Arrears repayment plans

Many repossessions can be avoided simply by opening communication early.

Seek free professional debt advice

Independent advisers can help negotiate with lenders and assess your options. This may include budgeting support, restructuring debts or exploring legal protections.

Consider remortgaging or restructuring

A broker may help you find a more affordable deal — particularly if your fixed rate is ending.

Check benefit eligibility

Some homeowners qualify for support with housing costs or mortgage interest.

Explore temporary solutions

If income loss is short-term — illness, redundancy, maternity leave — lenders often prefer temporary arrangements rather than repossession.

When selling may be the better option

However, if your financial difficulties are long-term or structural — for example:

-

Mortgage permanently unaffordable

-

Interest rate shock with no recovery

-

Unsustainable debt levels

-

Rental income no longer covering costs

-

Major life change affecting income

Then selling voluntarily is often far better than waiting for repossession.

Selling gives you:

✔ control over price

✔ control over timing

✔ ability to repay debt fully

✔ opportunity to protect credit rating

✔ chance to move on your own terms

Many homeowners and landlords who delay selling until arrears escalate find their options shrinking rapidly.

Repossession help for landlords

Landlords face additional risks.

If a buy-to-let property is repossessed:

-

Tenants may be forced to leave

-

Rental income stops immediately

-

Legal obligations to tenants can become complex

-

Mortgage shortfalls still apply

Selling before repossession can protect equity, reduce stress and avoid harming tenants unnecessarily.

The most important step: act early

Rising repossession numbers show what happens when problems go unresolved for too long.

Early action gives you choices.

Late action leaves you reacting to legal deadlines.

If you are searching for repossession help, the key principles are:

-

Talk to your lender early

-

Seek independent advice

-

Understand all your options

-

Act before court action begins

And if long-term affordability is no longer realistic, selling your property voluntarily is almost always a better financial and practical outcome than repossession.

Final word: control the outcome while you still can

Repossession is not just a financial event — it is a loss of control, stability and future opportunity.

If your difficulties are temporary, seek support immediately and work with your lender.

If they are long-term, make a proactive decision about your property before the lender makes it for you.

Because when repossession begins, your options shrink — and the costs rise.

Let’s take a moment to say what so few ever do – thank you, landlords. You’ve stood strong through year after year of government intervention, legislative shifts, financial penalties, and relentless negativity from the media and political class. And yet, through it all, you’ve continued to provide the backbone of housing in the UK – despite every obstacle that’s been thrown in your path.

Let’s take a moment to say what so few ever do – thank you, landlords. You’ve stood strong through year after year of government intervention, legislative shifts, financial penalties, and relentless negativity from the media and political class. And yet, through it all, you’ve continued to provide the backbone of housing in the UK – despite every obstacle that’s been thrown in your path.

Selling with tenants in place, or after they’ve left? A realistic route to a certain sale

Selling with tenants in place, or after they’ve left? A realistic route to a certain sale

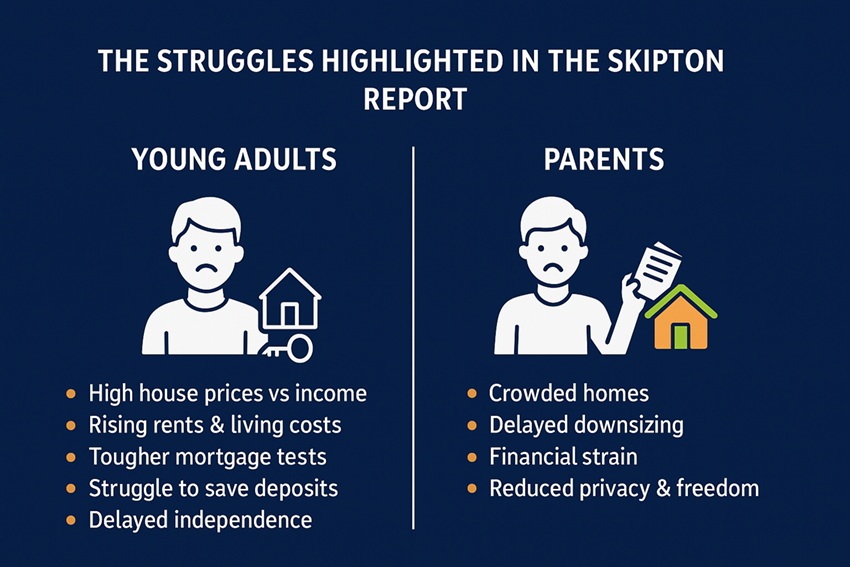

As we entered boldly into 2026, many landlords started the year with a clear message about the state of the sector. The government’s newly published civil penalty tables, which showed fines of up to £35,000 for breaches under the Renters’ Rights Act 2025 was just the tip of the iceberg in a nationwide “crackdown” on landlords.

As we entered boldly into 2026, many landlords started the year with a clear message about the state of the sector. The government’s newly published civil penalty tables, which showed fines of up to £35,000 for breaches under the Renters’ Rights Act 2025 was just the tip of the iceberg in a nationwide “crackdown” on landlords. It’s finally arrived, The Renters’ Rights Act, one of the biggest overhauls of the private rental sector, will come into action on 1st May 2026. The Act, which amongst other things including tighter regulations, the banning of Section 21 “no-fault” evictions, and the ability for tenants to request pets, whether or not landlords are comfortable with them in their properties, will also grant Councils more powers than ever before.

It’s finally arrived, The Renters’ Rights Act, one of the biggest overhauls of the private rental sector, will come into action on 1st May 2026. The Act, which amongst other things including tighter regulations, the banning of Section 21 “no-fault” evictions, and the ability for tenants to request pets, whether or not landlords are comfortable with them in their properties, will also grant Councils more powers than ever before. Many of us found ourselves having a quick chuckle at Chancellor Rachel Reeves this week after she was well and truly stung for not having a landlord licence. But as much as we might have enjoyed seeing government ministers under the spotlight, don’t forget that same lens will now well and truly be on us.

Many of us found ourselves having a quick chuckle at Chancellor Rachel Reeves this week after she was well and truly stung for not having a landlord licence. But as much as we might have enjoyed seeing government ministers under the spotlight, don’t forget that same lens will now well and truly be on us.

It’s been a tense few weeks as landlords were hit with mounting financial and regulatory pressures. As the countdown continues to the Renters’ Rights Bill, another blow seemed to hit when the Green Party passed a motion at its conference calling for “

It’s been a tense few weeks as landlords were hit with mounting financial and regulatory pressures. As the countdown continues to the Renters’ Rights Bill, another blow seemed to hit when the Green Party passed a motion at its conference calling for “

For many UK landlords, buy-to-let has been a profitable way to generate income and build wealth. But mounting legislation, expensive EPC upgrades, tax changes, and the constant burden of leasehold obligations are leaving many feeling stretched. If you’re a landlord looking for stability and fewer headaches, it might be time to consider build-to-rent (BTR).

For many UK landlords, buy-to-let has been a profitable way to generate income and build wealth. But mounting legislation, expensive EPC upgrades, tax changes, and the constant burden of leasehold obligations are leaving many feeling stretched. If you’re a landlord looking for stability and fewer headaches, it might be time to consider build-to-rent (BTR). If you were looking for a sign on whether or not to downsize or double down on your property portfolio, recent news has provided mixed messages on how landlords might be affected by the Renters’ Rights Bill.

If you were looking for a sign on whether or not to downsize or double down on your property portfolio, recent news has provided mixed messages on how landlords might be affected by the Renters’ Rights Bill.

The Proposal

The Proposal The Online National Residential Estate Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Estate Agency: Best Price Possible & Quickest Sale - guaranteed