And how National Residential can enable parents who want to become Bank of Mum & Dad to help their children.

Discover how the Bank of Mum & Dad can help children buy their first home. The Skipton Report highlights challenges facing young buyers and suggests downsizing to release equity as a win-win for parents and children.

National Residential can help families sell fast with certainty.

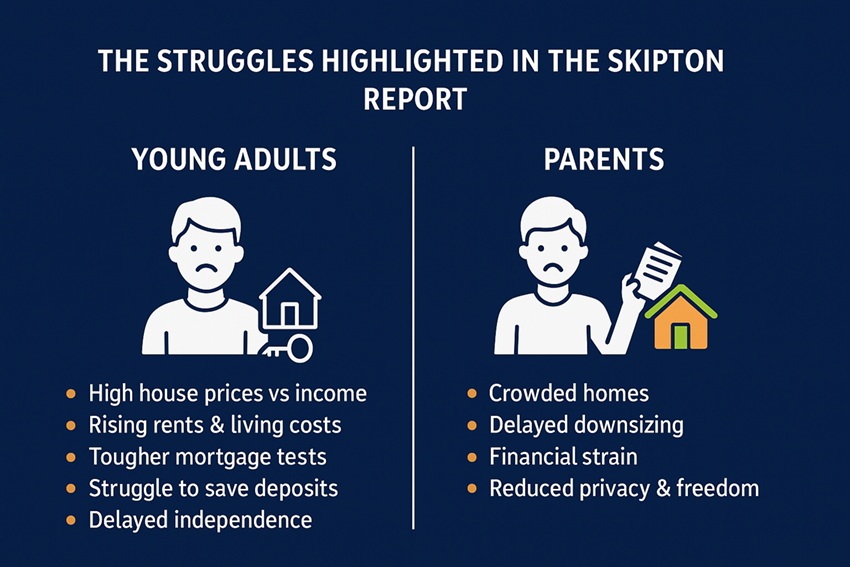

The Skipton Report: Why Young Adults Struggle to Buy

The Skipton Group’s Affordability Report (Sept 2025) shines a spotlight on the growing crisis facing first-time buyers. With rising living costs, stricter mortgage rules, and house prices far outpacing wages, more young adults are stuck at home longer — the so-called Adults Living with Parents (ALPs) generation.

The Challenges for Young Adults

-

High house prices compared to income

-

Rising rents and living costs blocking savings

-

Tougher mortgage affordability tests

-

Struggles to save a deposit while renting

-

Delayed independence and longer stays in the family home

The Challenges for Parents

-

Larger homes harder to maintain when children stay longer

-

Reduced privacy and independence in later years

-

Delays to downsizing or retirement plans

-

Financial pressure from supporting adult children

Downsizing to Release Equity: The Skipton Report’s Spotlight

The Skipton Report highlights downsizing to release equity as a potential solution for families. By moving to a smaller property, parents can unlock cash that helps their children secure a deposit or buy outright — while also simplifying their own lives.

Benefits for Children

-

A first step on the property ladder

-

Greater independence and confidence

-

Building equity instead of paying rent

Benefits for Parents

-

Cash released from property equity

-

Lower household bills and maintenance

-

More freedom, privacy, and peace of mind

-

The satisfaction of helping children succeed

How National Residential Can Help the Bank of Mum & Dad

When parents want to help their children buy a home, timing and certainty matter. That’s where National Residential steps in.

-

Fast, guaranteed property sales – no long waits, no broken chains

-

Cash unlocked quickly – enabling you to support your children when they find the right home

- Peace of mind – plan your move with certainty and confidence

![]() To read the Skipton Report, click here

To read the Skipton Report, click here

If you are ready to explore the Bank of Mum & Dad option, tell us what property you want to sell to start a conversation with National Residential today. We’ll help you sell fast, release equity, and make the move that secures your family’s future.

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed