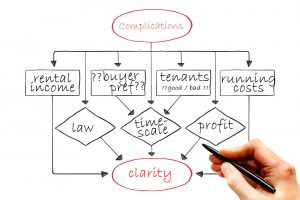

Landlords face many problems, most relate to property and/or tenants however ongoing economic and legislative changes have added a lot more things for landlords to worry about. Shrinking returns, increased costs, more rules, more penalties and the prospect of fewer options to end tenancies have resulted in more and more landlords selling some or all of their rental properties.

Over the next 12 months 41% of landlords said they plan to sell at least some rental properties, compared to just six per cent saying they would buy

Why are landlords selling up?

-

Tax hikes: The UK government’s planned tax hikes are putting pressure on the buy-to-let market.

-

Rising costs: Rising costs, taxes, and legislation are making it more attractive for landlords to sell.

-

Mortgage rates: Mortgage rates have spiked and are expected to remain high for longer.

-

Incentive repeal: The repeal of several incentives has put pressure on the buy-to-let market.

How National Residential Can Help Landlords Sell Property With Minimum Disruption To Rental Income…

Our business is providing our clients with a FAST, SECURED WAY TO SELL PROPERTY AND COMPLETE THE SALE. Typically, the whole process from start to finish takes between 7 – 87 DAYS… i.e. less than 13 weeks.

What’s more, we also specialise in tenant negotiations and selling tenanted property with vacant possession delivered in time for completion to minimise the period a property is not producing rental income to offset running/purchase costs.

Continue reading Landlords We Can Help You Streamline Your Portfolio →

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed