For many ex-landlords, the real problem begins after the tenants have gone.

By now, most landlords know that we specialise in selling rental property with tenants in situ, meaning there’s no need to go through the long-winded, stressful and often costly process of evicting tenants before a sale.

What some don’t realise, however, is that we also specialise in selling empty properties fast – and without owners having to spend months managing renovations, chasing contractors or pouring more money into an asset they’re already trying to exit.

Why ex-rental properties can be slow to sell

Once a rental property becomes empty, its flaws tend to become far more obvious. Issues that were tolerated during tenancies suddenly stand out to buyers – especially owner-occupiers, who make up a large part of the open-market audience.

Common problems that can significantly delay a sale include:

- Outdated kitchens and bathrooms

- Worn carpets, tired décor and poor presentation

- Historic maintenance issues that were never fully resolved

- Damp, mould or ventilation concerns

- Non-compliant electrics or plumbing

- Poor EPC ratings and the cost of improving energy efficiency

- Structural quirks or layout issues that deter mortgage lenders

- Properties that simply feel “run down” compared to competing stock

Individually, none of these issues are unusual. Combined, they can seriously limit buyer demand, reduce mortgage-ability and lead to repeated price reductions. Multiply that by the number of properties you want to sell and you can see why landlords selling empty properties in need of ‘freshening up’ – need help!

The hidden cost of chasing the best price

Many landlords assume the solution is to renovate and sell on the open market for top price. In theory, that makes sense. In reality, it often comes with hidden costs and delays that eat into any perceived uplift.

Ask yourself:

- Do you have the time to manage builders, surveys and compliance issues?

- Do you have the cash to fund works upfront?

- Are you willing to risk overspending and not getting that money back?

- Can you afford months of no rent, while still paying the mortgage, council tax, insurance and utilities?

- Have you factored in estate agency fees, staging, compliance costs and repeated viewings?

Once renovation costs, holding costs and time are properly accounted for, many landlords realise that holding out for 100% of market value isn’t always the most profitable – or least stressful – option.

Is it better to sell for 85 – 90% and walk away with no more costs to pay?

For some ex-landlords, making a small sacrifice on the price can actually leave them in a stronger position overall.

Why?

- No renovation costs

- No months of mortgage payments with no rental income

- No exposure to market changes while the property sits unsold

- No stress, no project management, no uncertainty

When you compare a clean, certain sale today against an expensive and time-consuming refurbishment followed by an unpredictable open-market sale, 15% compromise on price often looks more like 5% by the time all costs are considered.

Vacant possession doesn’t mean “problem-free”

Even if you already have vacant possession, that doesn’t automatically make a property easy to sell.

If a property needs work, buyers will still factor that into their offers – often heavily. Mortgage lenders may also down-value or refuse to lend altogether, shrinking the pool of potential buyers.

That’s why landlords with empty properties in poor or tired condition should talk to National Residential. The price we estimate is always linked to the comparable sales and how much work is required to get the sale to completion – not simply whether the property is empty or tenanted – so if the fewer factors we have to consider, the better the offer we can make.

A flexible approach that puts the numbers first

We have contractor teams across the UK and we take a numbers-led approach to every sale.

If it makes financial sense to carry out improvements – meaning the uplift in sale price outweighs the cost and time involved – we can use our Cash Advance Fund to pay for works upfront.

Key points landlords like about the Advance Fund:

- No interest

- No upfront payment from the seller

- Deducted from sale proceeds on completion

- Designed solely to maximise sale price and speed

If the numbers don’t stack up, we will offer an alternative route that prioritises certainty and speed instead.

As well as the limited companies and corporations looking for tenanted properties, we also have thousands of developers and cash buyers looking for properties they can improve for profit.

The Housing Market in 2026

The current UK housing market is characterised by high stock levels and longer average selling times, particularly for properties that are anything less than “show-home ready”.

For ex-rental properties that are a little tired – or in some cases in need of major renovation – the timeline from preparation to sale and completion can easily stretch beyond 9 – 12 months. During that time, costs continue to mount and market conditions can change.

Speak to National Residential to decide your next move

If you’re an ex-landlord with an empty property that isn’t selling or isn’t ‘market ready’, or you’re worried about paying the mortgage with no rent coming in, it’s worth having a conversation before committing to costly works or further price reductions.

We can help you understand:

- Whether renovation genuinely makes financial sense

- How much work is needed to get the best possible price

- Whether a faster, lower-stress sale could leave you better off overall

The right solution isn’t always the highest headline price – it’s the best price achieved in the shortest time, with the least risk and hassle.

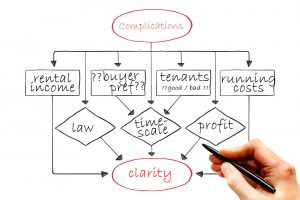

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

Section 24 is a HMRC taxation change affecting what costs can be deducted from rental income to calculate ‘Net Profit’ – i.e. the figure counted as income and the figure that you will pay taxed against.

Section 24 is a HMRC taxation change affecting what costs can be deducted from rental income to calculate ‘Net Profit’ – i.e. the figure counted as income and the figure that you will pay taxed against.

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed