You don’t always have to sell your home just because you’re struggling to pay your mortgage.

A debt adviser can help you create a budget, prioritise your debts, and speak directly with your lender and other creditors to help avoid repossession.

However for some people, selling their property and completing quickly to avoid repossession rather than risk being made homeless is the best option to deal with a very stressful and unpleasant experience – both emotionally and financially.

Let’s be realistic. You won’t get the same price you might achieve if your lender was willing to wait six months or more and take the risk of a collapsed sale through a high street agent (hint: most aren’t willing). But if you choose National Residential, you can sell and complete quickly—and walk away with more money than you would if evicted and your home sold at a traditional auction (which is the route most lenders prefer because of its certainty and speed).

Some people try to avoid repossession by handing back their keys—this is called voluntary repossession. While this might spare you the trauma of being physically evicted, your home will likely be sold at a traditional auction for about 70% of its value. That means you could still owe your lender tens of thousands of pounds after the sale. Until the property sells, you’re also still responsible for mortgage interest, insurance, and maintenance costs.

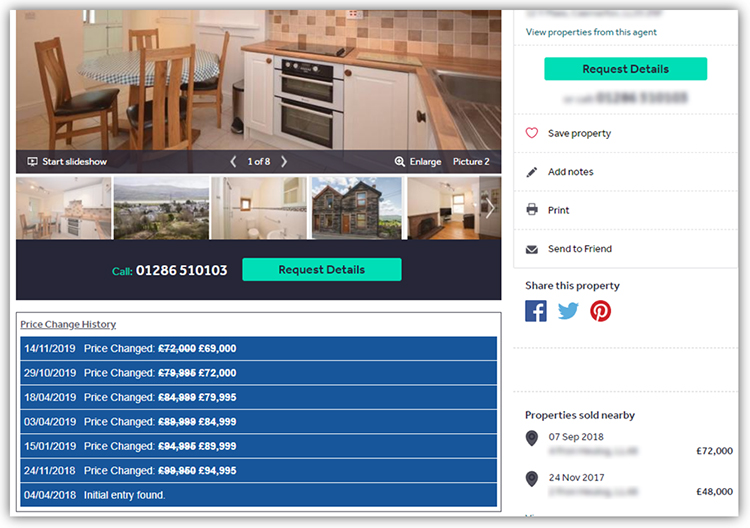

Why do properties sell for so little at traditional auctions?

Because the pool of buyers is severely limited – some auctions are only open to people who can physically attend the event, while others are only open to cash buyers (due to having to complete in 28 days) and/or to people who can bid on the day of the auction in very short bidding windows. Fewer bidders means lower offers. If the sale price doesn’t cover your mortgage, you’ll still have to pay the shortfall.

How Are National Residential Auctions Different?

We tailor our auctions so that noone is excluded. They are online, properties are advertised on RightMove and are usually open for 28 days so buyers can place a bid any time day or night during that window. We give buyers 56 days to complete which means our auctions attract buyers who lend to buy as well as cash bidders and our consultants are available to answer buyers questions and ‘hold hands’ with nervous bidders. What’s more, sellers do not pay to be listed in our auctions – we pay all costs from our fee.

When To Sell Your Home Rather Than Let It Be Repossessed

Shelter highlights the benefits of selling your home yourself before repossession in their article Selling your home to avoid repossession. They say doing so:

- Puts you in control of the sale

- Helps you plan your move

- Can help you clear your mortgage and arrears

- May leave you with money to rent or put towards a deposit on a new home

We at National Residential strongly agree. You can see how this worked for one of our clients in our case story: How We Helped a Seller Walk Away From a Repossession with £20K in Profit Rather than £5K in Debt.

However, Shelter also advises against using quick sale property companies, claiming, “some companies make money out of buying homes for less than they are worth.” This sweeping statement is both unfair and misinformed.

Quick sale companies like National Residential offer a practical, reliable route to sell your home fast—within the tight timeframes lenders often demand to avoid repossession. Most properties are listed at a trade price based on previously sold properties in the area sales. They are then sold to the public who bid against each other to determine the final sales price. Unless we agree to buy your property ourselves so that we can complete in 7 – 14 days, we earn our income from by providing a service to find and secure reliable buyers quickly, not by buying the properties ourselves. We follow a code of conduct approved by The Trading Office and reguated by NAPB.

Of course, sellers who need a quick sale must be realistic about the offer they will receive. David Coughlin, CEO of National Residential, explains:

“Our valuations—normally 10–15% below market value—must be fair to sellers, provide enough margin for us to be paid, and be attractive to buyers. While sellers might get slightly more through a high street agent, our speed and service are unmatched. We offer far better results than traditional auctions, which used to be the only alternative.

We’re completely transparent in our pricing and promises. Our goal is to offer sellers a fast, efficient, and less painful way to sell—without sacrificing more than necessary.”

For more insight into how our offer prices are calculated, see our guide: Setting House Prices.

The Office of Fair Trading also recognise the value in the services we provide. After a full study, they concluded that “this [the Quick Property Sales services] is a dynamic and innovative sector where some businesses have modified their business models to try to offer a better service to home sellers.”

To learn more, visit our section on Regulated Quick House Sales.

How National Residential Can Help Homeowners Avoid Eviction

If you’ve missed several mortgage payments, can’t afford interest-only repayments, or feel overwhelmed, a quick sale might be your best option.

Lenders typically get in touch after 3–6 missed payments. They are legally required to try to negotiate with you before going to court. But if talks fail, they’ll issue a formal notice and apply for a possession order. If granted, lenders can evict you and sell your home to recover what you owe — including fees, legal costs, and interest until the day the loan is paid.

For many homeowners, selling the property is the only way to stop repossession. But high street sales are slow and uncertain. Many fall through. Because of this, some lenders won’t halt repossession proceedings unless they see a clear, guaranteed path to repayment.

That’s where we come in.

At National Residential, we sell homes in 28 days or less using online auctions that attract a wider pool of buyers. We secure firm offers quickly, and all buyers must complete within 56 days. Our service gives most lenders the assurity they need to stop repossession — and once we have found a buyer we will contact your lender on your behalf to stop the repossession .

What’s more, if the lender insists on the arrears being paid before they will stop the repossession, we can provide an interest free cash advance (to be paid back from the sale of the property) as soon as the buyer has paid a non-refundable deposit.

When Less Is More

Accepting 85% of your home’s market value now to stop repossession is far better than holding out for 100% — if your lender won’t wait. Repossession usually leads to a forced auction sale at 70% of value, with fees added on top.

Sometimes less is more:

- Avoid Repossession: Selling puts you in control and stops court proceedings.

- Protect Your Credit Score: Repossession can seriously damage your credit.

- Secure a Better Price: A managed, fast sale can beat auction results.

- Free Up Cash: Use the funds to clear debts and start fresh.

We take pride in our transparent pricing and exceptional service.

Contact us today to see how we can help you avoid repossession and stop further charges from adding to your debt.

As the saying goes: one step forward, two steps back. Just as we thought we were getting out of the danger zone, this week’s shot to the jugular kicked off with the resurfacing of videos referencing Prime Minister Keir Starmer claiming that landlords “do not qualify as working people.” It was the scandal of last October, and as Labour’s rumoured tax plans were announced, the past reared its ugly head with the simple truth that: landlords are in trouble.

As the saying goes: one step forward, two steps back. Just as we thought we were getting out of the danger zone, this week’s shot to the jugular kicked off with the resurfacing of videos referencing Prime Minister Keir Starmer claiming that landlords “do not qualify as working people.” It was the scandal of last October, and as Labour’s rumoured tax plans were announced, the past reared its ugly head with the simple truth that: landlords are in trouble. Let’s be honest, there’s many reasons you might be thinking of selling right now, and many ways to potentially sell, but nothing’s going to beat the success we’re seeing at Landlord Sales Agency. In the last week alone, we’ve had almost 70 landlords reach out to us and sell, and with the Renters’ Rights Bill just around the corner, that number is increasing daily.

Let’s be honest, there’s many reasons you might be thinking of selling right now, and many ways to potentially sell, but nothing’s going to beat the success we’re seeing at Landlord Sales Agency. In the last week alone, we’ve had almost 70 landlords reach out to us and sell, and with the Renters’ Rights Bill just around the corner, that number is increasing daily.

The property market is shifting, and it’s becoming clearer every day what serious buyers are really looking for: property companies and blocks of six or more properties. These investment opportunities aren’t just a trend — they’re the most efficient way for buyers to expand their portfolios while keeping costs down. For landlords considering selling, this demand creates a fantastic opportunity to exit the market with a smooth, profitable deal.

The property market is shifting, and it’s becoming clearer every day what serious buyers are really looking for: property companies and blocks of six or more properties. These investment opportunities aren’t just a trend — they’re the most efficient way for buyers to expand their portfolios while keeping costs down. For landlords considering selling, this demand creates a fantastic opportunity to exit the market with a smooth, profitable deal. As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough. In England and Wales, leasehold ownership grants you rights to a property for a fixed term, but not the land it stands on. When a lease runs out the buildings on the land become the property of the freehold (land) owner. Most flats in England and Wales are leasehold.

In England and Wales, leasehold ownership grants you rights to a property for a fixed term, but not the land it stands on. When a lease runs out the buildings on the land become the property of the freehold (land) owner. Most flats in England and Wales are leasehold.

What Happens If You Can’t Pay Your Mortgage?

What Happens If You Can’t Pay Your Mortgage?

A mass sell-off is currently underway in the landlord sector, and it only looks set to increase. EPC requirements, The Renters Rights Bill, mounting financial pressures, the list of reasons goes on.

A mass sell-off is currently underway in the landlord sector, and it only looks set to increase. EPC requirements, The Renters Rights Bill, mounting financial pressures, the list of reasons goes on.

Waiting for viewings can be a stressful, and despairing time. Buyers are expected to present their properties to get the most from viewings and are often encouraged to declutter and/or to depersonalise and/or to keep properties clinically clean for viewings. While all those suggestions are excellent (see below for more of the same), keeping a home in pristine condition can be expensive, time consuming and stressful. It’s no wonder most people would prefer lots of viewings in a short time frame than maintaining often impractical and inconvenient standards over prolonged periods because of a lack of viewings.

Waiting for viewings can be a stressful, and despairing time. Buyers are expected to present their properties to get the most from viewings and are often encouraged to declutter and/or to depersonalise and/or to keep properties clinically clean for viewings. While all those suggestions are excellent (see below for more of the same), keeping a home in pristine condition can be expensive, time consuming and stressful. It’s no wonder most people would prefer lots of viewings in a short time frame than maintaining often impractical and inconvenient standards over prolonged periods because of a lack of viewings.

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed