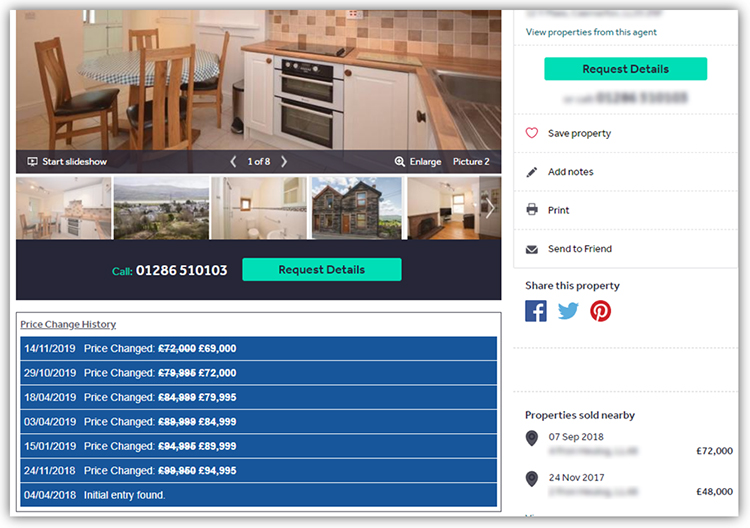

The single most important thing to get right to sell your house fast is the asking price. Almost every property will attract attention from buyers if the price is right so if you aren’t even getting many viewings, it could be a sign that buyers think your asking price is too high for the size and type of property compared to others in your area.

Finding the Right Asking Price to Sell Your Property

The ideal asking price is the highest price buyers are willing to pay within your desired timeframe. Overpricing leads to delays, while underpricing may cause regret.

We look at how to price your property to get the best price in the fastest time.

What Happens If You Price It Wrong?

❌ Too Low – Quick sale, but you risk selling for much less than market value.

❌ Too High – Fewer viewings, longer time on the market, and price reductions.

Continue reading Setting A House Price

Because our auctions are open to private buyers with mortgage funding (not just cash buyers who are often developers looking to buy a property at rock bottom prices so they can make a profit when reselling),

Because our auctions are open to private buyers with mortgage funding (not just cash buyers who are often developers looking to buy a property at rock bottom prices so they can make a profit when reselling),

Endowment Mortgage Shortfall: Contact National Residential for Help

Endowment Mortgage Shortfall: Contact National Residential for Help The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed