Are All Property Auctions The Same?

ABSOLUTELY NOT – also, worthy of note: not all bidders are the same either – our auctions recognise that.

The method we use to sell property is often referred to as a ‘Modern‘ Property Auction’ (also known as conditional auctions). It is different to many other types of auction (offline and online) because of what happens when the bidding ends. In a Modern Property Auction when bidding ends the winning bidder pays a non refundable deposit to secure the property but the crucial difference is the winning bidders are given time to secure lending.

Because our auctions are open to private buyers with mortgage funding (not just cash buyers who are often developers looking to buy a property at rock bottom prices so they can make a profit when reselling), our properties typically sell for 10 – 15% more than similar properties sold at auction houses.

Our fees are lower too, (see next section)!

Similar to the ‘sealed bids’ process, in our auctions a winning bid is the BEST offer the seller chooses to accept which is usually but not always the highest bid. Like traditional auctions, all bids are legally binding and the bidding process is transparent so all bidders are kept informed of other bids throughout the process.

Continue reading Property Auctions

Section 24 is a HMRC taxation change affecting what costs can be deducted from rental income to calculate ‘Net Profit’ – i.e. the figure counted as income and the figure that you will pay taxed against.

Section 24 is a HMRC taxation change affecting what costs can be deducted from rental income to calculate ‘Net Profit’ – i.e. the figure counted as income and the figure that you will pay taxed against.

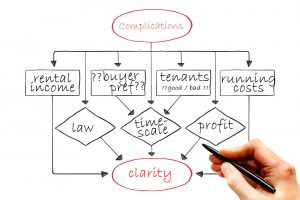

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

As has been widely reported, UK landlords are leaving the Private Rented Sector (PRS) for many reasons. From Section 24 and dwindling profits to tenant pressure groups and legislitative interventions – landlords all over the UK have had enough.

The National Association of Property Buyers (NAPB) was founded in 2013 in response to to the growth in popularity of Quick House Sales companies.

The National Association of Property Buyers (NAPB) was founded in 2013 in response to to the growth in popularity of Quick House Sales companies. “The fast sale market is split into two types: those that buy properties and those that broker sales.

“The fast sale market is split into two types: those that buy properties and those that broker sales.

BANKRUPTCY CHARGES CAN DOUBLE A DEBT.

BANKRUPTCY CHARGES CAN DOUBLE A DEBT. WARNING

WARNING

Endowment Mortgage Shortfall: Contact National Residential for Help

Endowment Mortgage Shortfall: Contact National Residential for Help The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Agency: Best Price Possible & Quickest Sale - guaranteed