I’ve been working with landlords for years, and if there’s one thing I’ve noticed recently, it’s this: demand for blocks of six or more properties has skyrocketed. We’ve seen a spike in enquiries of buyers wanting to buy several properties at once to kick-start their portfolios.

I’ve been working with landlords for years, and if there’s one thing I’ve noticed recently, it’s this: demand for blocks of six or more properties has skyrocketed. We’ve seen a spike in enquiries of buyers wanting to buy several properties at once to kick-start their portfolios.

These aren’t old landlords, they’re new landlords with fresh investment and property buying companies looking to add to their corporate portfolios. What does this mean? What it means is that if you’re a landlord who’s been in the business for a while, and wants to shift your properties, this could be the ideal time to tap into that demand.

We’re not just talking a few buyer enquiries, my network of 30,000+ buyers are actively seeking them right now.

So if you’re looking to sell, and you want to connect directly to serious buyers looking to purchase properties like yours, you’ll want to read on.

Thousands of landlords are feeling the pinch as rising costs, talk of rent caps, and upcoming EPC regulations add pressure to an already challenging rental market.

Thousands of landlords are feeling the pinch as rising costs, talk of rent caps, and upcoming EPC regulations add pressure to an already challenging rental market. We’re two months away from December. New legislations, tax, and changes for tenants are around the corner, and understandably the race to sell before the end of the year is well and truly on.

We’re two months away from December. New legislations, tax, and changes for tenants are around the corner, and understandably the race to sell before the end of the year is well and truly on. t’s been tense week this week as landlords waited patiently for Rachel Reeves’ Autumn Budget. As the countdown began to the Chancellor’s announcement, the biggest fear for landlords was a possible hike in Capital Gains Tax.

t’s been tense week this week as landlords waited patiently for Rachel Reeves’ Autumn Budget. As the countdown began to the Chancellor’s announcement, the biggest fear for landlords was a possible hike in Capital Gains Tax.

This week the Telegraph hit the nail on the head when they reported that Landlord profits had collapsed in the past decade following an onslaught of taxes and red tape.

This week the Telegraph hit the nail on the head when they reported that Landlord profits had collapsed in the past decade following an onslaught of taxes and red tape.

A mass sell-off is currently underway in the landlord sector, and it only looks set to increase. EPC requirements, The Renters Rights Bill, mounting financial pressures, the list of reasons goes on.

A mass sell-off is currently underway in the landlord sector, and it only looks set to increase. EPC requirements, The Renters Rights Bill, mounting financial pressures, the list of reasons goes on.

David Coughlin, CEO of Landlord Sales Agency recently joined forces with Paul Shamplina, the Founder of Landlord Action, TV presenter, author of articles, books and blogs as well as a regular speaker at property seminars and conferences, to identify and discuss key steps landlords need to take to achieve the highest profits from their portfolios in 2023. The webinar was watched bu hundreds of landlords and they were inundated with questions from those watching.

David Coughlin, CEO of Landlord Sales Agency recently joined forces with Paul Shamplina, the Founder of Landlord Action, TV presenter, author of articles, books and blogs as well as a regular speaker at property seminars and conferences, to identify and discuss key steps landlords need to take to achieve the highest profits from their portfolios in 2023. The webinar was watched bu hundreds of landlords and they were inundated with questions from those watching.

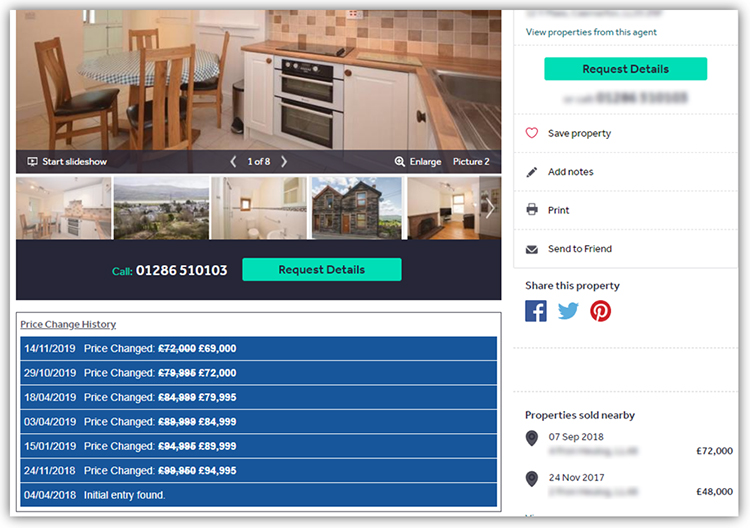

Waiting for viewings can be a stressful, and despairing time. Buyers are expected to present their properties to get the most from viewings and are often encouraged to declutter and/or to depersonalise and/or to keep properties clinically clean for viewings. While all those suggestions are excellent (see below for more of the same), keeping a home in pristine condition can be expensive, time consuming and stressful. It’s no wonder most people would prefer lots of viewings in a short time frame than maintaining often impractical and inconvenient standards over prolonged periods because of a lack of viewings.

Waiting for viewings can be a stressful, and despairing time. Buyers are expected to present their properties to get the most from viewings and are often encouraged to declutter and/or to depersonalise and/or to keep properties clinically clean for viewings. While all those suggestions are excellent (see below for more of the same), keeping a home in pristine condition can be expensive, time consuming and stressful. It’s no wonder most people would prefer lots of viewings in a short time frame than maintaining often impractical and inconvenient standards over prolonged periods because of a lack of viewings.

The Online National Residential Estate Agency: Best Price Possible & Quickest Sale - guaranteed

The Online National Residential Estate Agency: Best Price Possible & Quickest Sale - guaranteed